Tax Clearance

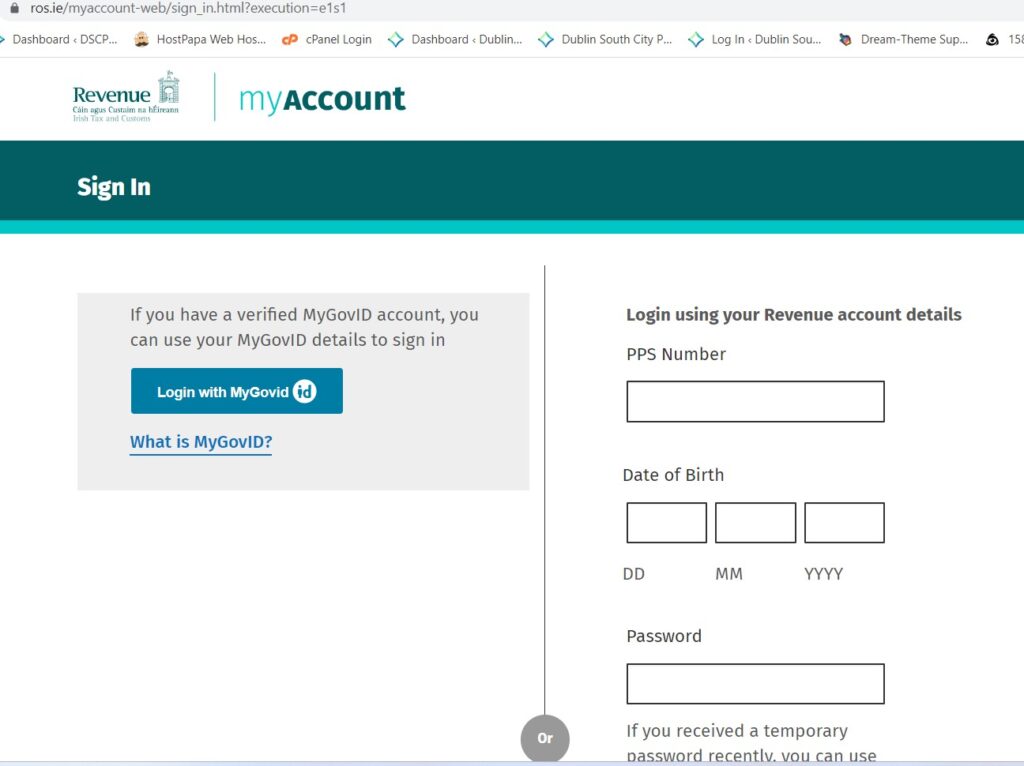

If you are registered for myAccount, click ‘Tax Clearance’ on the Manage My Record card. If you are registered for the Revenue Online Service (ROS), this service is available by clicking on either: the Manage Tax (Tax Revenue ‘May Account’ login screen below)

How do I prove that I hold a Tax Clearance Certificate?

When we issue your Tax Clearance Certificate, we will also give you a Tax Clearance Access Number (TCAN). You can give this access number, along with your Personal Public Service Number (PPSN) or Tax Reference Number, to anyone who needs to verify your Tax Clearance Certificate.

You can print the result screen using the print button on the screen. The result is also sent to your ROS or MyEnquiries inbox. You can view, print or save the certificate by selecting ‘Manage Tax Clearance’ from the services in ROS or myAccount.

Tax and PRSI

How your business is taxed depends on whether it is incorporated as a company. If it is a company then it is liable for corporation tax. If it is not incorporated you are considered to be a sole trader and you pay tax under the self-assessment system. Further information is available on the Revenue website. PRSI: If you are self-employed you pay Class S social insurance contributions. There is a guide PRSI for the Self-Employed.

There is more information in our documents on becoming self-employed and closing or selling a business.

Please note that the STEA is subject to income tax but the BTWEA is not subject to tax You can claim Start Your Own Business Relief if you are getting the Back to Work Enterprise Allowance (BTWEA). This provides a 2-year exemption from income tax (up to a maximum of €40,000 per year) for people who have been unemployed for at least 12 months (312 days) before starting their own business. You do not have to pay tax, PRSI or Universal Social Charge on the Back to Work Enterprise Allowance but you may have to pay tax, PRSI and Universal Social Charge on any income you get from self-employment (if it is over the exempted amount as above). The Revenue Receipts Tracker App (RRTA) is a free app which allows you to upload details and images of your receipts to Revenue. You can manage your receipts and expenses in real-time. No tax is deducted at source by the Department of Social Protection. All enquiries about your tax liability should be addressed to the Revenue Commissioners.